Sherwood Investments

Planning Today for Tomorrow

We are in the business of helping people simplify their financial lives and exceed their financial expectations. We don’t rely on long questionnaires that you hate to fill out, but talking with you to fully understand your objectives. We specialize in retirement planning and managing investments exceeding well.

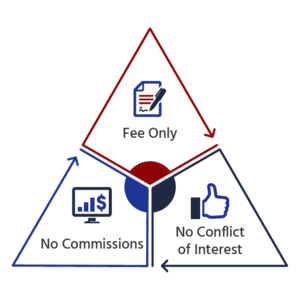

There are no commissions. We are fee-only.

Our only compensation is structured so that we benefit when you benefit.

All calls to us are returned within one business day.

Call us at 425-898-8989 or click here: Improve my financial future today .

Retirement Planning and Investment Management

Expert retirement and estate planning, including advice on how to maximize your Social Security benefits and plan for retirement. We help our clients retire financially secure.

Personal Financial Strategies

We help people of all ages achieve their dreams. Financial plans and portfolios are dynamic and updated as needed, not just once a year, to help you reach your financial goals.

Independent, Fee-Only, Unbiased Financial Advice

Our fees are structured so that we do better when you do better. We are fee-only and receive no commissions for buying or selling any investment for you. Being totally independent, we report only to you and can always do what is best for you.

Sherwood Investments

In our years of experience managing investments, we’ve fine-tuned our proven, six-step process.

Eric J. Linger

Sherwood Investments

Eric J. Linger is a Registered Investment Advisor (RIA) and the principal of Sherwood Investments. When it comes to financial services, he values the close and personal contact with every client.

Before founding Sherwood Investments, Mr. Linger was the branch manager of a major Edward Jones investment office in Somerville, NJ. He started his career as an electrical engineer at Bell Labs and advanced to senior executive positions in financial planning and analytical areas at AT&T.

Mr. Linger received a Bachelor of Science in Electrical Engineering (BSEE) from Penn State, a Master of Science in Electrical Engineering (MSEE) from New York University, and an MBA from Monmouth University.

What is a Fiduciary?

A fiduciary cannot accept any commissions or have any conflicts of interest. Because we are a fiduciary, our recommendations are always in your best interest. We even put this in writing for you.

Have more questions?

We work with a network of other investment professionals to develop your financial plan and manage your investments to fit your objectives best. Regardless of where you live, we can work with you.

Our clients reside in over a dozen different states.

Don’t hesitate to contact us with any questions or concerns or to book an appointment. No matter where you reside, we’ll work closely with you. We look forward to hearing from you.

“Our only compensation is based on the value of your portfolio. So when your portfolio grows, we both benefit.”